Best ROI Properties in Abu Dhabi — Top Investment Destinations for 2025/2026

Abu Dhabi’s real estate market moved from recovery to momentum in 2024–2025. Rising transaction volumes, strong demand in both affordable and luxury segments, and a steady flow of government-backed infrastructure projects mean investors can find high-yield opportunities and long-term capital appreciation if you take into consideration the right micro-markets and product types. This guide identifies the best ROI properties in Abu Dhabi for 2025/2026, ranks the top neighbourhoods by investment case, and gives practical, no-nonsense advice on how to capture superior returns.

Market snapshot (what the numbers say)

H1-2025 data shows clear winners. Premium investment islands such as Saadiyat, Yas, and Al Raha Beach — led luxury price gains, with per-sqft increases in some cases exceeding mid-teens year-on-year. Affordable and mid-tier pockets such as Al Reef, Masdar City and parts of Al Reem Island delivered the strongest rental yields, with Al Reef reporting yields above 9% in 2025 and Masdar / Al Reem in the high-7s to low-9s range for certain apartment stock. Transaction volumes and new masterplan launches (Hudayriyat, Fahid Island, Wadeem plots) show continued institutional and retail demand.

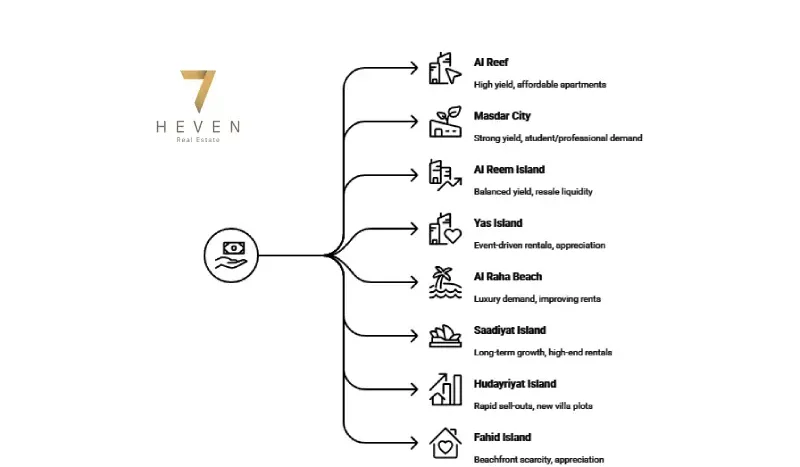

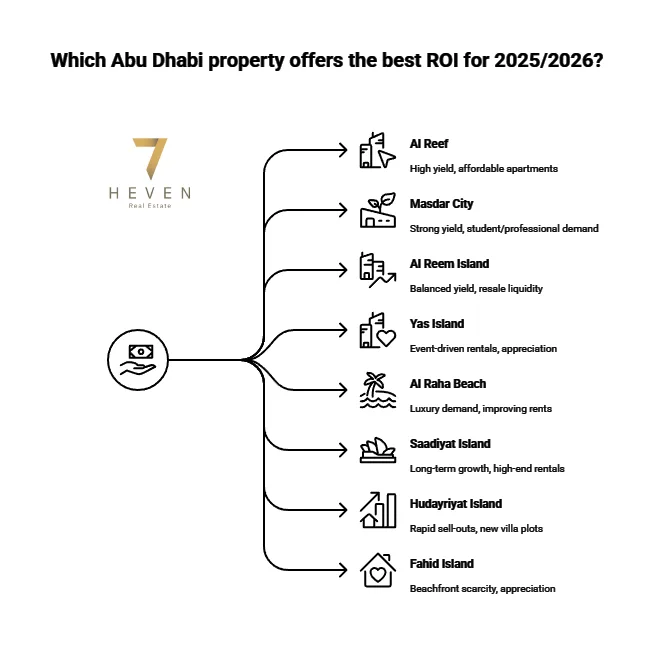

Top ROI destinations for 2025/2026 — quick list

Below are the best ROI properties in Abu Dhabi by category and why they matter.

Al Reef (Affordable apartments) — Top yields (≈9%+).

Masdar City (Mid-market apartments) — Strong yields and steady demand from students & professionals.

Al Reem Island (Mid-to-upper apartments) — Balanced yield (≈7–8%) + resale liquidity.

Yas Island (Luxury apartments & short-term lets) — Event-driven rental spikes; good mid-term appreciation.

Al Raha Beach (Premium apartments & waterfront villas) — Luxury demand + improving rents.

Saadiyat Island (Luxury & cultural premium) — Long-term capital growth; high-end rental demand.

Hudayriyat Island (New villa plots & masterplan) — Massive early demand and quick sell-outs (Wadeem plots sold out rapidly).

Fahid Island (New Aldar launches: Fahid Beach Residences / Terraces) — Beachfront scarcity positioning for long-term appreciation.

Each of these locations serves a slightly different investor profile — from yield-hungry cash buyers to long-term value seekers after trophy villas and penthouses.

1 — Al Reef: Yield-first, cashflow engine

Why it’s a top ROI pick: Al Reef is the classic cashflow play. With established rental demand, affordable entry prices and proven yields above 8–9% in 2025, it’s ideal for investors focused on monthly income rather than immediate flip gains. Al Reef works especially well for portfolio investors who want to buy multiple units, lower per-unit transaction costs, and profit from steady occupancy. Data shows Al Reef offers one of Abu Dhabi’s best net yields in the affordable segment.

Investor playbook: target 1- and 2-bed apartments with stable tenants (hospital staff, teachers, young families), keep fit-outs durable, and budget for conservative vacancy (5–8%). Expect strong cash-on-cash returns if financed with modest leverage.

2 — Masdar City: sustainable yields + future upside

Why it’s a top ROI pick: Masdar is maturing into a robust rental market because of institutional tenants, university presence and demand for tech-enabled living. Mid-tier apartments in Masdar delivered strong yields in H1-2025 and attract eco- and tech-savvy tenants who often prefer longer leases. Masdar’s positioning as a green-tech hub gives it a differentiated demand profile that supports stable rents and gradual appreciation.

Investor playbook: buy compact units aimed at professionals and students, use local property managers specialising in corporate lets, and emphasise green-tech features in marketing to command a premium.

3 — Al Reem Island: liquidity + balanced returns

Why it’s a top ROI pick: Al Reem balances yield and liquidity. Yields in Al Reem are attractive for investors (mid-to-high 7% reported for certain stock), and the island benefits from mature resale markets and a wide buyer pool (families, professionals, students). Al Reem’s mix of mid-rise and high-rise stock makes it simple to match product to tenant demand.

Investor playbook: buy 1-2 bed apartments in towers with proven management; these rent quickly to professionals and short-term assignees. Reposition older stock with modest renovations for rental premium.

4 — Yas Island: event-driven upside + short-term rental potential

Why it’s a top ROI pick: Yas Island is a unique hybrid: strong year-round events (Formula 1, concerts, theme parks) drive short-term rental demand and seasonal rate spikes. Luxury apartments and family villas near Yas Marina command premium rents during peak months. For investors who manage or outsource short-term lets, Yas can dramatically lift gross yields in high-season windows — but you must manage licensing and operations.

Investor playbook: if you plan short-term lets, focus on high-occupancy months, professional management, and compliance with local short-stay regulations. For steady income, buy well-appointed apartments suited for families or corporate leasing.

5 — Al Raha Beach & Saadiyat Island: premium yield + capital growth

Why they’re top ROI picks: Both locations attract affluent tenants and international buyers. Al Raha Beach showed strong rental growth in the luxury segment (notably 1-bed growth in H1-2025) while Saadiyat recorded some of the highest per-sqft price rises in H1-2025. These areas suit investors targeting capital appreciation and higher-end rental yields.

Investor playbook: target well-located apartments or small villas; prioritize sea/park-facing exposure, concierge amenities and properties with strong community management to preserve resale value.

6 — Hudayriyat & Wadeem plots: land scarcity and masterplan demand

Why it’s a top ROI pick: Hudayriyat’s first plot release (Wadeem) sold out within days — a clear signal of strong demand for residential land and villa plots. With masterplanning focused on leisure, sport and family living, early buyers of plots or villa-offerings capture structural upside from infrastructure and scarcity. If you’re looking for high long-term capital growth rather than immediate yield, masterplan plots and early villa inventory are compelling.

Investor playbook: land and plot plays are long-horizon (5–10 years). Secure trusted developers or land plots with clear title and infrastructure commitments. Expect lower near-term cashflow but high upside on delivery and community completion.

7 — Fahid Island: beachfront scarcity & wellness positioning

Why it’s a top ROI pick: Aldar’s Fahid Island projects (Fahid Beach Residences, Fahid Beach Terraces) position the island as a wellness-led beachfront alternative to established islands. Beachfront scarcity plus Aldar’s developer credibility make Fahid a strong candidate for long-term capital appreciation and premium rents for well-positioned units. New launches and high demand for beach-lifestyle living support the investment case.

Investor playbook: consider beachfront apartments and penthouses for trophy holdings; smaller apartment units at launch can be flipped or held for mid-term gains depending on payment-plan attractiveness.

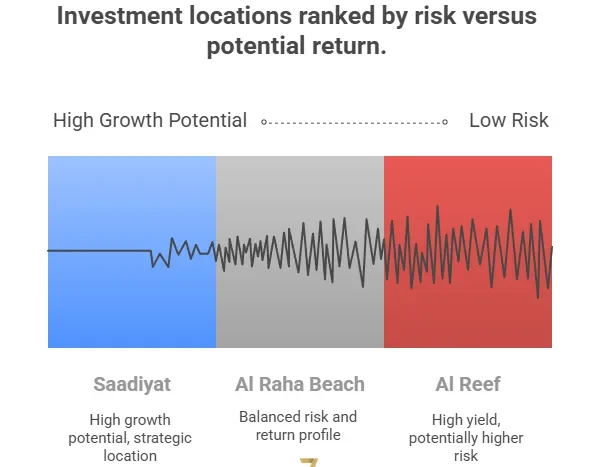

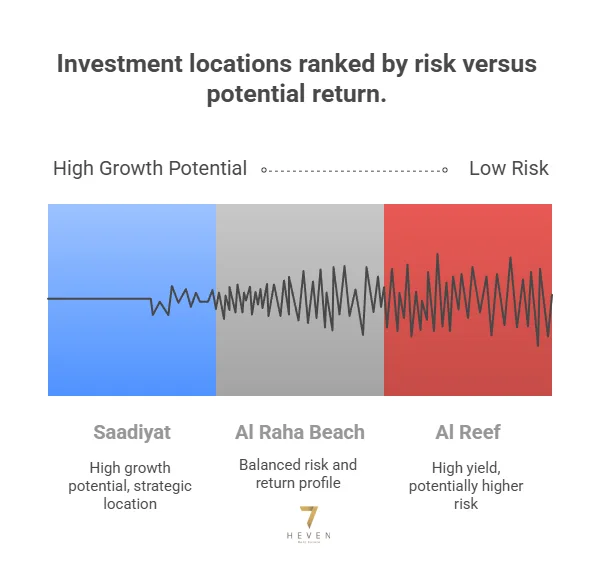

How to choose between yield vs capital growth properties

Yield-first strategy (cashflow): pick Al Reef, Masdar City, Al Reem — focus on affordable to mid-market apartments with strong occupancy.

Balanced strategy (yield + growth): choose Al Raha Beach, Yas Island or selected Al Reem towers — these combine good rents with capital upside.

Growth-first strategy (capital appreciation): target Hudayriyat plots, Fahid Island beachfront units, and prime Saadiyat villas/penthouses.

A balanced portfolio often mixes 1–2 cashflow units with one “trophy” asset (villa/penthouse) that captures appreciation.

Financing, payment plans & how they affect ROI

Financing conditions matter more than many investors realise. In 2025 UAE banks continue to offer competitive mortgage packages and developers are using flexible payment plans (off-plan 55/45, 60/40 or similar) to attract buyers. These terms allow you to:

Reduce upfront cash through staged payments,

Lock in early pricing on off-plan launches, and

Leverage appreciation while spreading capital outlay.

Always model ROI under different financing scenarios — a 30% down payment vs 50% down changes cash-on-cash returns dramatically. For buy-to-let investors, prioritise fixed-rate options where available to stabilise mortgage servicing.

Practical ROI checklist — before you buy

Run net yield, not gross yield. Subtract service charges, management fees and 5–10% vacancy buffer.

Verify service charge history. High or rising fees can destroy net return.

Check developer reputation & delivery track record. Execution risk kills returns in off-plan.

Assess tenant profile. Proximity to hospitals, universities, business parks = steady income.

Confirm ownership & freehold status. International buyer access affects resale liquidity.

Stress-test financing at +1–2% interest shock. Ensure cashflow survives rate moves.

Plan exit routes. Know buyer demand for your unit type and likely days-on-market.

Risks to monitor

Macro shocks & rate rises: Even with stable 2025 rates, global shocks can compress liquidity and slow sales. Stress-test your model.

Oversupply in some sub-markets: Watch project pipelines; areas with heavy new supply can temporarily depress rents.

Developer delays: Off-plan delivery risks mean holding costs and missed rental income; stick with proven developers or require clear completion guarantees.

Quick comparison table (high-level)

(Use this as a one-glance guide when screening deals)

Best for yield: Al Reef, Masdar City, parts of Al Reem (yields 7–9% reported).

Best for balanced returns: Al Raha Beach, Al Reem prime towers, Yas Island.

Best for capital growth: Saadiyat, Hudayriyat, Fahid Island (strategic masterplans & beachfront scarcity).

Final word — Short-term vs Long-term Real Estate Investments: Flipping vs Holding (Pragmatic strategy for 2025/2026)

If you’re asking “where are the best ROI properties in Abu Dhabi?” the honest answer is: it depends on whether you want to flip or hold. Each micro-market favours a different strategy — choose the market that matches your time horizon, risk appetite and capital structure.

Short-term (Flipping) — 0–3 years

Target: quick capital appreciation from off-plan launches, early secondary resale and entry-price arbitrage.

Best neighbourhoods: Al Reem (select towers), Fahid Island launches, and select Al Raha Beach mid-market apartments — these areas offer active secondary demand and attractive off-plan payment plans.

Key tactics: secure early launch pricing, negotiate developer incentives (furnishing credits / marketing support), minimise holding costs (short handover windows), and have a trusted sales broker lined up before completion. Stress-test your flip for a conservative appreciation case (3% pa) and ensure your break-even covers holding costs and sales fees.

Medium / Long-term (Holding) — 5–10+ years

Target: steady rental income, mortgage amortisation and capital appreciation driven by infrastructure and scarcity.

Best neighbourhoods: Al Reef, Masdar City (yield-first, cashflow engines) and Saadiyat, Hudayriyat, Fahid (growth-first, beachfront/masterplan scarcity). Villas, penthouses and beachfront apartments are ideal long-hold trophies; studios/1-beds in value pockets produce reliable cashflow.

Key tactics: prioritise net yield (after service charges), lock favourable fixed-rate mortgages if available, choose quality property management, and hold through at least one market cycle (5–7 years) to capture Vision-driven appreciation.

Quick action plan (flip vs hold)

Decide your objective & time horizon — flip if you plan on having some proceeds in less than 3 years or hold if incase you want a longterm plan (5–10 years).

Set target metrics — minimum net yield for holds (e.g., 4–6% net); minimum price appreciation for flips (e.g., 8–12% over project cycle).

Run two scenarios — conservative (3% per annum) and optimistic (7–8% per annum) for 3–5 year windows.

Shortlist 2–3 units that meet your metrics (one primary, one backup).

Request hard numbers — service-charge history, recent tenancy contracts, and sold comps.

Secure financing & terms — get mortgage pre-approval and lock any developer payment plan that improves cashflow.

Stress-test exit — know transfer costs, likely buyer segments, and expected days-on-market.

Execute with contingency cash — keep reserves for vacancies, delays or unexpected costs.

If incase you want more information on Abu Dhabi Real Estate investments, please feel free to contact us: marketing@heven7.ae