Is This the Best Time to Buy Property in Abu Dhabi?

Short version: Yes — for many buyers and investors, Abu Dhabi’s current mix of stable borrowing costs, strong rental demand and large infrastructure projects creates a compelling buying window. But the “best” time depends on your goals (cashflow vs capital growth), holding period and risk tolerance. This article breaks the market down, shows real-world drivers (interest rates, demand, infrastructure) and runs clear ROI scenarios so you can judge for yourself.

Abu Dhabi’s property market has shifted from opportunistic, speculative cycles to a more institutional, income-seeking market. Transaction activity, rising prices in prime locations, and strong rental performance have encouraged both private investors and some institutional capital. Meanwhile mortgage products with multi-year fixed options and attractive bank offers have improved buyer certainty. These trends together change the rent-vs-buy maths for many tenants and investors.

The three pillars that determine “the best time”

To decide whether now is right for you, weigh three pillars:

-

Borrowing costs (interest rates & mortgage availability)

-

Demand & rental market strength

-

Infrastructure & Vision-level projects that drive long-term capital appreciation

1) Interest rates & financing — predictability matters

After several global rate shocks, UAE banks are offering competitive fixed-rate mortgage packages (multi-year fixed options are commonly available). Leading Abu Dhabi banks publish fixed offers in the 3.9%–4.4% range for creditworthy buyers for limited fixed periods — meaning buyers can lock repayment certainty for 1–5 years in some products. This makes leveraged purchases less risky than variable-only environments.

What this means for investors:

-

Cashflow visibility: multi-year fixed rates let you forecast mortgage servicing with confidence.

-

Leverage plays differently: with predictable interest costs, investors can more safely model buy-to-let cashflows.

-

Timing & negotiation: in markets where rates are stabilising, developers may re-introduce more attractive payment plans (off-plan 60/40 or other staged schedules).

Practical note: compare fixed vs variable offers and always stress-test your model for +1%-2% rate shocks.

2) Demand: tenant quality, yields and who’s moving in

Abu Dhabi benefits from a high-quality tenant pool: government staff, oil & gas professionals, senior executives, diplomats, and growing tech/AI hires. Rental demand in many Abu Dhabi micro-markets is strong; recent market reports show attractive gross yields in several neighbourhoods, with affordable and mid-tier pockets delivering particularly high yields (double-digit yields for affordable segments, and solid 6–8% levels in many mid/luxury pockets). These yield levels support buy-to-let strategies and make rent-vs-buy comparisons favourable in many scenarios.

Investor takeaways:

-

High gross yields in value pockets (e.g., Al Reef, Masdar City) can deliver cashflow quickly.

-

Prime islands (Saadiyat, Yas) are more about stable income + strong capital gain potential than ultra-high immediate yields.

-

Short-term rentals can boost peak returns in tourist or events-driven pockets, but check licensing and community rules.

3) Infrastructure & Vision 2030 — the long game

Abu Dhabi’s Vision 2030 projects (cultural district expansions, island masterplans, transport and airport upgrades) are not marketing copy — they represent large public investments that improve accessibility and tourism, and therefore property demand. Examples include the Saadiyat cultural cluster (Louvre, Guggenheim, Zayed National Museum), Hudayriyat’s leisure transformation, and newly unveiled masterplans such as Fahid Island — all of which increase long-term desirability of nearby housing. These are structural tailwinds for capital appreciation over the 5–10 year horizon.

Market snapshot (facts you can use)

-

Recent market reporting shows broad-based price appreciation and heightened investor interest in H1-2025. Transaction volumes and capital flows into Abu Dhabi residential assets remain robust.

-

Rental yields are attractive in several Abu Dhabi micro-markets; H1-2025 reports show yields above 7% in some luxury pockets and over 8–9% in affordable segments.

How to evaluate ROI — a quick primer

Return on a property investment has several components:

-

Net rental yield (rental income after fees, vacancy, service charges, management).

-

Mortgage servicing (interest + principal payments) — affects cashflow and equity build via amortisation.

-

Capital appreciation — price growth over your hold period.

-

Transaction costs on sale (agent fees, transfer costs).

-

Equity build from principal repayment.

When you combine cashflow over the hold period + equity at exit, you get a measure of total investor return. Below are two worked examples so you can see the math in practice.

Worked ROI examples (assumptions & results)

I computed two realistic examples using conservative inputs and bank-level interest rates — the full numeric tables for both scenarios (monthly mortgage, NOI, cashflow, principal repaid, net sale proceeds and ROI on down payment for 5-year holds) are provided alongside this post (you should see the detailed tables available as a download / attached outputs). I’ll summarise results here and explain how to interpret them.

Common assumptions used in both examples

-

Selling costs (agent+misc) = 2% of final sale price

-

Management fee = 5% of annual rent

-

Vacancy allowance = 5% of annual rent

-

Service charges: example-specific (commonly higher in luxury buildings)

-

Appreciation scenarios modelled: Conservative 3% p.a. and Bullish 8% p.a. over a 5-year hold

-

Mortgage interest: taken from bank published fixed offers (example rates ~4.0%–4.2% used).

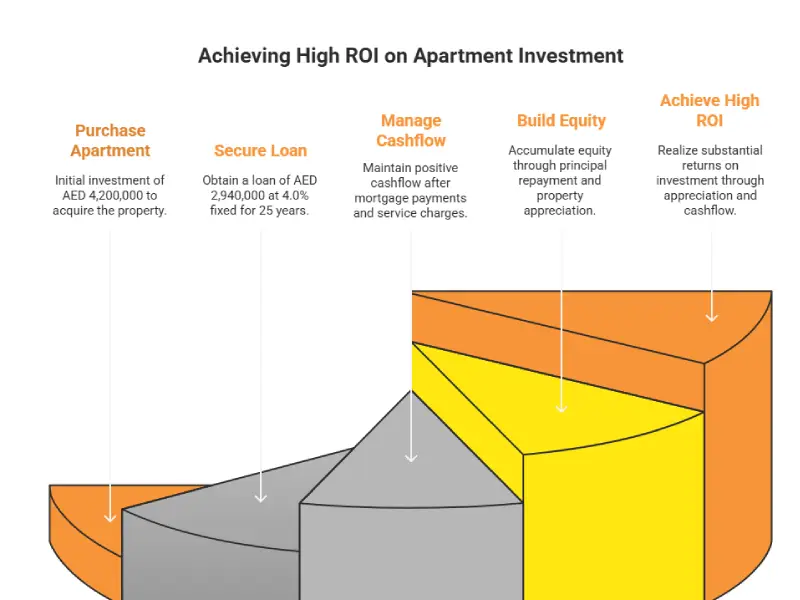

Example A — 1-bed apartment (typical investor unit)

Assumptions (example):

-

Purchase price: AED 4,200,000

-

Expected rent: AED 22,000 / month → AED 264,000 / year (market comps)

-

Down payment: 30% → AED 1,260,000

-

Loan: AED 2,940,000 at 4.0% fixed for 25 years

-

Service charges (example): AED 30,000 / year

Key computed outcomes (summary):

-

Gross yield: 264,000 ÷ 4,200,000 = ~6.3%

-

NOI before debt service: annual rent − service charges − management − vacancy

(for these inputs, NOI ≈ AED 207,600) -

Annual mortgage servicing (first year): computed with amortisation formula (monthly payment), results shown in the attached table — this is the largest single cashflow item.

-

Cashflow after mortgage (year-1): modest positive or near-break-even depending on exact rate and fees (see table).

-

Principal repaid in 5 years: meaningful (tens of thousands AED annually cumulative) → equity build.

-

5-year outcomes:

-

Conservative case (3% p.a.): modest capital gain; ROI on initial down payment is positive but conservative.

-

Bullish case (8% p.a.): substantial price uplift; combined cashflow + principal repaid + net sale proceeds can deliver high ROI on down payment (table shows exact % under each scenario).

-

Interpretation: The apartment is a classic hybrid: reasonable gross yield (supporting buy-to-let), predictable tenant demand, and pronounced upside if the area appreciates strongly. Even with modest cashflow after mortgage, equity build + appreciation drives long-term investor returns.

Example B — 4-bed villa (family/villa asset)

Assumptions (example):

-

Purchase price: AED 9,500,000

-

Expected rent: AED 55,000 / month → AED 660,000 / year

-

Down payment: 35% → AED 3,325,000

-

Loan: AED 6,175,000 at 4.2% fixed for 20 years

-

Service charges (example): AED 60,000 / year

Key computed outcomes (summary):

-

Gross yield: 660,000 ÷ 9,500,000 = ~6.95%

-

NOI before debt service: annual rent − service charges − management − vacancy (see table)

-

Annual mortgage servicing: computed precisely (see table).

-

Cashflow after mortgage (year-1): typically positive but depends on financing package and service charges. Villa buyers often accept lower gross yields than apartments because villas offer capital appreciation + strong long-term tenant demand.

-

5-year outcomes:

-

Conservative (3% p.a.): solid gains, good equity build and stable cashflow.

-

Bullish (8% p.a.): superior ROI driven largely by capital appreciation.

-

Interpretation: Villas often deliver a balance of attractive rental income and strong capital appreciation in high-demand family locations. Because down payments are larger, ROI on cash invested should be judged against the investor’s capital allocation goals.

What these examples teach you (practical lessons)

-

Gross yield tells only part of the story. Debt servicing, service charges and vacancy materially affect net cashflow. Always calculate NOI and cashflow after mortgage.

-

Equity build is a real source of return. Principal repaid over a few years adds to total returns even if cashflow is thin in year-1.

-

Appreciation assumptions dominate outcomes. In the examples, switching from 3% to 8% p.a. over 5 years transforms returns from modest to excellent. That’s why location and project execution matter.

-

Entry price and timing matter. Locking in an off-plan price or a favourable payment plan can materially improve ROI.

-

Liquidity/time horizon matters. Abu Dhabi favours medium-to-long hold strategies for the smoothest returns; flippers can make money but need perfect timing and low execution risk.

Practical checklist before you buy

-

Get pre-approval: Know the mortgage product, LTV and fixed rate options. Compare bank offers.

-

Run the numbers: Net yield, cashflow after mortgage, principal repaid, sale costs and two appreciation scenarios (conservative + optimistic). Use the templates from the examples.

-

Verify service charges & rules: Luxury developments often carry high fees; factor these in.

-

Confirm developer track record & delivery timelines. Off-plan always has schedule risk.

-

Map tenant demand: Who will rent this unit? Corporate relocations, diplomats, families, tourists? That drives vacancy and rental rates.

-

Exit planning: Know resale demand and comparable days-on-market for your unit type.

Where to focus in Abu Dhabi (quick, actionable picks)

-

Value pockets for yield: Al Reef, Masdar City — strong yields (reports show >8–9% in some affordable pockets).

-

Lifestyle & capital growth: Saadiyat Island, Yas Island, Fahid Island and Hudayriyat — buyer demand is premium and infrastructure projects boost long-term upside.

-

Family villas & townhouses: Reem Hills, Khalifa City and selected gated communities—steady long-term tenant demand and capital preservation.

Conclusion

If your goal is long-term wealth-building (5–10+ years), now is a favorable time to buy in Abu Dhabi: fixed-rate mortgage options, strong tenant demand, and Vision-backed infrastructure projects combine to create an asymmetric opportunity set.

If you are a short-term flipper, you must pick units with demonstrable resale demand and low execution risk (developer reputation, payment plan, clear secondary market). For many investors, a blended approach (flip a small number of units, hold trophy assets) balances risk and return.