What Type of Property Gives the Best ROI in Abu Dhabi?

Investors, developers and high-net-worth families asking “What type of property gives the best ROI in Abu Dhabi?” are responding to one simple reality: Abu Dhabi’s residential market is no longer a single, predictable lane. In 2024–2025 we saw strong demand across product types ; but with divergent outcomes depending on product, location and holding horizon. The data shows villas leading on capital growth, apartments delivering strong rental yields, and townhouses performing as the compromise. This guide breaks those outcomes down, shows step-by-step ROI math you can reuse, and gives a practical checklist for making the right buy , whether you’re searching for a Villa for sale in Abu Dhabi, an Apartment for sale in Abu Dhabi or a Townhouse for sale in Abu Dhabi.

How we measure ROI (quick primer)

To compare apples with apples, we measure three key metrics:

Gross rental yield = (Annual rent ÷ Purchase price) × 100

Net yield = Gross yield − (service charges + management + maintenance + insurance)

Total return (over a holding period) = Rental income (total) + Capital appreciation (sale price − purchase price) ÷ Purchase price

We’ll use both short-term (annual/net yields) and medium-term (5-year total return) lenses because product choice depends heavily on your time horizon.

Market snapshot: what the 2024–2025 data tells us

Abu Dhabi’s residential market strengthened across 2024 and into 2025: prices and rents rose, and master-planned islands and suburban villa communities saw outsized interest. Independent market reviews and local portals confirm two important findings:

Villas have been the top-performing asset in price appreciation across recent reporting periods — Knight Frank and other consultancies highlight villa price uplifts and a strong 2024–Q1 2025 performance.

Apartments continue to offer higher percentage rental yields than villas on average, especially in high-demand, young-professional submarkets. REIDIN/market data estimates Abu Dhabi apartment yields to be around the mid-6% to high-6% range in recent reporting.

Local rental reports also show rising rents across product types, with apartments showing quick rental growth and villas showing steady absolute-rent gains.

Product-by-product breakdown

Apartments for sale in Abu Dhabi — the yield champions

Why apartments win (for certain investors):

Higher gross yields: Apartments typically deliver higher percentage yields (often in the mid-5% to high-6% range and above in select micro-markets), making them attractive for cash-flow investors.

Lower ticket price: Easier mortgage access and a broader buyer pool — helpful for buyers seeking diversification or smaller exposure.

High tenant demand: 1–2 bedroom apartments attract professionals, corporate tenancies and short-term lets, supporting occupancy.

Drawbacks to watch:

Service charges can significantly reduce net yields — always check the service-charge schedule.

Supply sensitivity: apartment markets react quickly to new launches; rental growth can be cyclical.

Where to look: Al Reem Island, Al Raha, Yas Island, and parts of Khalifa City have been active apartment markets for investors searching “Apartment for sale in Abu Dhabi.” Use AD rental index and local portals to validate asking rents.

Villas for sale in Abu Dhabi — capital growth leaders

Why villas attract long-term investors:

Strong capital appreciation: Multiple market reviews show villas leading price growth across Abu Dhabi in recent cycles — prime island and waterfront villas have been especially strong.

Higher absolute rental income: Villas command larger monthly rents, useful if your cash-flow model relies on nominal rent rather than percentage yield.

Stable tenant profile: families and long-term occupiers create lower turnover.

Drawbacks to weigh:

Lower percentage yields than apartments (commonly lower single digits to low-mid single digits).

Higher running costs: maintenance, landscaping, pools and insurance can erode net returns.

Liquidity: bigger ticket sizes mean selling can take longer.

Where to look: Saadiyat Island, Yas Island, Al Raha and established suburban villa communities (Khalifa City, Al Reef) have been notable for villa demand and price performance.

Townhouses for sale in Abu Dhabi — the compromise play

Why townhouses are compelling:

Balance of yield and appreciation: Townhouses often deliver higher yields than premium villas while offering better appreciation potential than typical mid-tier apartments.

Appeal to families: outdoor space, multiple bedrooms and community facilities attract stable, longer leases.

Lower operational overhead vs villas: shared community maintenance often reduces individual owner burden.

Drawbacks:

Segment heterogeneity: townhouses vary widely in layout and quality; the micro-market matters more here.

Less standardized comps: townhouses can be harder to price quickly in a sale.

Where to look: Masterplanned communities and family-oriented submarkets on Yas Island, Al Raha and selected gated communities.

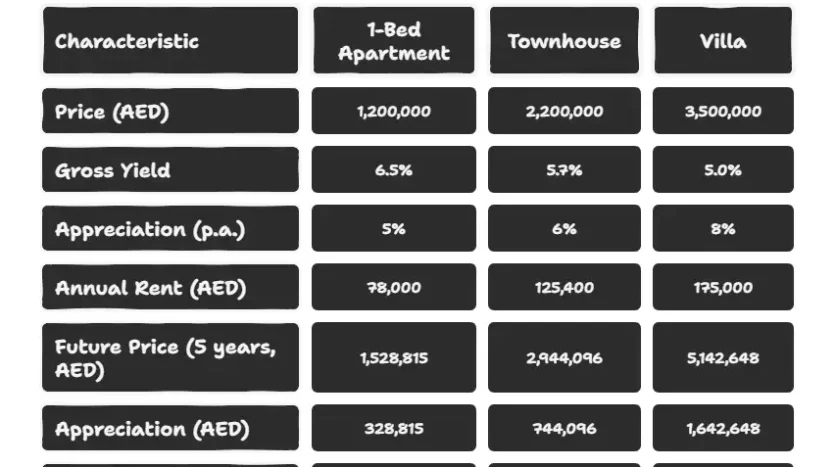

Illustrative ROI scenarios (5-year, conservative examples)

Below are three step-by-step, reproducible scenarios — use them as templates for your own inputs.

Assumptions (conservative and illustrative):

1-bed apartment price: AED 1,200,000; gross yield: 6.5%; appreciation: 5% p.a.

Townhouse price: AED 2,200,000; gross yield: 5.7%; appreciation: 6% p.a.

Villa price: AED 3,500,000; gross yield: 5.0%; appreciation: 8% p.a.

These values reflect typical ranges reported across Abu Dhabi portals and market reports; replace with your actual comps to get precise projections.

Apartment (example)

Annual rent = AED 1,200,000 × 6.5% = AED 78,000

Future price in 5 years = 1,200,000 × (1.05)^5 = AED 1,528,815

Appreciation = AED 328,815

5-year total return = (78,000 + 328,815) ÷ 1,200,000 = 34.07% (≈ 6.0% p.a.)

Townhouse (example)

Annual rent = AED 2,200,000 × 5.7% = AED 125,400

Future price in 5 years = 2,200,000 × (1.06)^5 = AED 2,944,096

Appreciation = AED 744,096

5-year total return = (125,400 + 744,096) ÷ 2,200,000 = 39.4% (≈ 6.9% p.a.)

Villa (example)

Annual rent = AED 3,500,000 × 5.0% = AED 175,000

Future price in 5 years = 3,500,000 × (1.08)^5 = AED 5,142,648

Appreciation = AED 1,642,648

5-year total return = (175,000 + 1,642,648) ÷ 3,500,000 = 51.9% (≈ 8.7% p.a.)

Interpretation: if villas keep outpacing appreciation expectations, total returns will beat apartments despite lower percentage yields. If price growth slows, apartments’ stability and higher yields could outperform in total return and cash flow. Use the AD Rental Index and local comps to stress-test your numbers.

Transaction costs, tax & regulatory considerations (Abu Dhabi specifics)

No annual property tax in the UAE, but expect transfer fees, developer/service charges, agent commissions and mortgage fees that reduce net returns.

Service charges: especially critical for apartments — they can cut 1–3 percentage points from gross yields in some developments. Always request the current service-charge register.

ADREC Rental Index: use it to benchmark realistic rental assumptions rather than optimistic agent asking rents.

Micro-market matters more than product type

The same villa in a prime island community will behave differently than an outlying villa in an emerging suburb. The three micro-factors that change ROI most are:

Proximity to schools, hospitals and transport — buyers and tenants pay premiums for convenience.

Developer and build quality — better build quality reduces future capex drains and improves resale.

Masterplan amenities — beach access, marinas and integrated retail drive both rents and exit pricing.

Use hyperlocal comps (last 6–12 months) and the ADREC rental index to validate assumptions before purchase.

Practical investor checklist — before you buy

Decide horizon: <2 years (liquidity) vs 5–10 years (appreciation).

Run net yield: deduct service charge, management fee (8–12% of rent typical if using an agency), maintenance and vacancy buffer.

Obtain 12 months of actual rent roll and 6–12 months of comparable sales.

Stress test with flat-price and lower-rent scenarios.

Check resale demand in the submarket — how many similar units sold in the last 6 months?

If financing, model interest rate sensitivity — higher rates can compress yields quickly.

Final verdict : Our recommendations

If you prioritise cash flow and faster exit/entry: target an Apartment for sale in Abu Dhabi in high-demand submarkets. Apartments win for yield and liquidity.

If your goal is long-term capital appreciation and you can ride volatility: pursue a Villa for sale in Abu Dhabi in prime masterplans and islands. Villas have led price appreciation.

If you want a balanced portfolio exposure: add a Townhouse for sale in Abu Dhabi to combine family-tenant stability with upside potential.

Remember: location, tenant profile and holding period are the real ROI levers — product type is secondary.